8 Personal Finance Philosophies of the Rich

“Too many people spend money they haven’t earned, to buy things they don’t want, to impress people that they don’t like.”

One thing that is common and evident among the wealthy and successful is their ability to master their personal finance. Self-made millionaires and billionaires are known to be thrifty, sensible and frugal. Schools do not really teach personal finance and many believe that the ability to handle money well is a natural flair rather than a learned art.

The recipe for financial stability is not exactly a secret. It is out there, preached and lived through by the wealthy and successful. Here are some of the basic personal finance viewpoints that are worth imitating;

1. Spend less of what you earn

This is the most basic of all personal finance rules – do not spend more than you can afford to pay. Yet, this is also where we most fail. Access to credit gives us the power to spend money we still don’t have. It is good to a certain degree, but only if we have enough discipline over our spending. Managing personal finance starts with learning to live within your means. Know exactly how much you’re making, then create a budget that is within your income. Use your credit wisely.

2. Budget for savings

Build up your savings from day one. This follows the first rule of managing personal finance. What is left of your income after expenses are your savings. First, aim to create an emergency fund – one that you can rely on emergencies or when starting up a business or transitioning from one job to another. Second, save for investment – one that will provide you with a passive income. Lastly, start saving for your retirement – the earlier you start, the sooner you can retire.

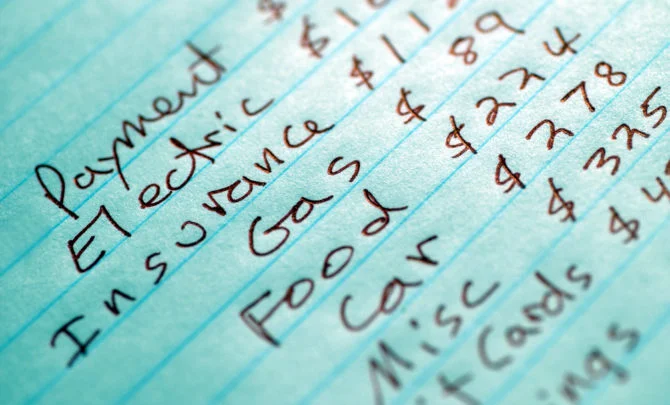

3. Know what you’re spending on

Self-made millionaires and billionaires still live on a budget and know exactly where their money is going. Knowing what you’re spending on will give you a clearer idea on how you’re handling your money. Create a list of purchases made and bills paid, go as detailed as you can. Scan through your list – do you see opportunities to save or minimise your expenses? Are you spending too much on coffee or interest fees?

4. Create passive income

Passive income are earnings generated without you having to work or spend time on it. Royalties, rentals, interest income, and creative licenses are examples of passive income you can build on. You can create and sell – photography, ebooks, music, and apps. You can also use your savings to invest in properties you can rent out like real estate properties, machines, equipment, or even party needs! Passive income sources will double your earnings without using up time and effort.

5. Learn the art of investing

Money in the bank is safe but is not most beneficial for you. While you can earn interest income, you could also be losing value from inflation. Inflation is the continuous trend of increasing prices and decreasing value of money. At an average rate of 2.5%, your $100 now will be worth about $80 in ten years. To combat inflation, you must put your money to good use, in income generating investments.

6. Take advantage of free money

Nothing is for free, right? If you look closer, there is such thing as free money. Financially aware individuals know and take advantage of free money like miles rewards, loyalty rewards from stores, discounts given when paying in cash or in advance, and your employer’s contribution match for health insurance or retirement fund.

7. Simplify your lifestyle

Downsizing is enriching. Getting rid of the clutter will let you focus on the important things. Do you really need the second car, a bag to match your new shoes or the extra guest bedroom? Keeping up with the Joneses will not get you and your family anywhere. There’s no shame in frugality. Self-made millionaires wear simple clothes, live in modest homes, and drive basic cars. They splurge on more important things like investments, innovations, and on making sure they enjoy work-life balance.

8. Health is wealth

Stay healthy. A healthy body and focused mind are necessary to better able to work and create wealth and income. Besides, getting sick is expensive. Having a sick child will also create the same stress and additional expenses. Make yours and your family’s health a premium. Eat healthy, exercise, sleep well, avoid harmful vices, and make time for fun and relaxing time together.

Personal finance can be learned and anyone can achieve financial freedom and wealth. It is just a matter of knowing what you have, and effectively managing and enriching it. Discipline, hard work and perseverance are important aspects of getting rich. If you want to make it, do not rely on luck or the benevolence of others.