The Long Road to Financial Freedom in Seven Steps

“It is not the man who has too little, but the man who craves more, that is poor.”

Everyone is talking and dreaming about financial freedom. What does financial freedom mean to you? Does it mean unlimited purchasing power? Is it the big house, latest model cars, and expensive vacations? Is it freedom from debt? Retirement?

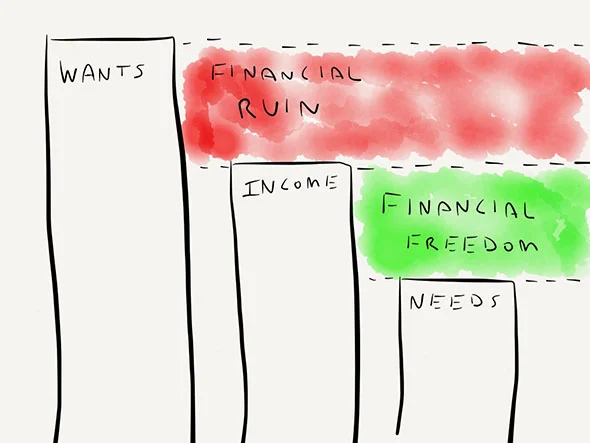

The hard truth is that financial freedom is not the accumulation of wealth. Rather, it is the mastery you have over your finances. It is not having enough money and not having the need to work. It is the freedom to choose what you do – to work on things that you love, and not because you need the pay. Being financially free is earning more than your expenses, regardless of the amounts. A man who earns $100,000 and spends $85,000 is more financially free than the person who earns $500,000 and spends $600,000.

So how do you get from your financial position now to financial freedom? It will be a long and hard process, almost impossible to most. Are you up to your neck in debts? No savings? No properties to call your own? You have to start from somewhere, the important thing is that you start, now.

1. Know where you are financially

Where are you exactly in the money scale? Take into account all your financial details. How much are you earning? Get the amounts of your total debts, interest expenses, overdue debts, family expenses, and your assets. Any anticipated expenses like planned vacations, medical expenses, or school payments? Make a list of everything, and make sense out of your list. How much in a bad shape are you financially?

2. Learn how to manage your money

Now that you see the big picture from step one, you are in a better position to know what needs to be done. Managing your money is all about keeping your expenses lower than your income. If your expenses are higher than your income, you either have to increase your income – find another job or do something to augment family income, or lessen the expenses. As expenses are more controllable, the second option is easier. Here are some ways to lower your expenses;

Ø Track your expenses.

Ø Eliminate unnecessary spending. Minimize eating out, cook at home.

Ø Substitute expensive entertainment with cheaper or free activities.

Ø Create a budget and stick to it.

Ø Take up gardening. You get free exercise and fresh produce for a lot less.

Ø Recycle, repair, reuse.

Ø Know the value saving and practice frugality.

3. Create a long term plan

The road to financial freedom never easy. It is even harder for families with growing children. Expenses are increasing, more unpredictable, and harder to manage. Following the same principle – expenses lower than income, create a long term plan that will eventually get you out of financial mire. This might involve living in smaller homes, sending kids to nearer and more affordable schools, taking up a second job, starting a small business from home, and keeping just one car.

4. Get out of debt

You’re now able to manage your finances, you have a plan, and you’re implementing it. The next step is to try to get out of debt. Many people find this as the hardest step because they see paying off debts as an expense they can minimize and thus just pay as little as they can get away with. The truth is that paying low increases your debt and its interest expense. To get out of debt, prioritize payment of high interest carrying debts. You can also take a consolidating loan that will pay off all your debts, restructure your payment scheme, and lower the interest expense. Do not hesitate to consult with a financial manager or adviser to discuss your best possible options.

5. Pay yourself

Start investing in yourself. Save up a certain amount or at least 20% of your total income for your emergency funds, savings, and retirement. Also set aside a certain amount for your family’s healthcare and lifestyle. Creating a separate fund to spend on vacations, occasional splurges, and entertainment is vital to maintain a level of contentment.

6. Start investing

The next step is to start making your money work for you. With enough savings, your money can take some of the burden of earning for your family. There are many ways to invest your money. Another discussion with a financial expert is advised. Again, at this point, you still have to maintain the same level of work and income. Any investment earnings should be channeled directly to savings or additional investment.

7. Protect your wealth

At this stage, you can almost feel free from any financial burden. Do not let all the hard work go to waste. Protecting your wealth is important to ensure your financial freedom. At this point, you could have the freedom to stop working or choose a more enjoyable profession. You are debt-free, have enough savings, and a good source of supplemental income. Protecting your wealth is ensuring that your investments are sound, your savings are also invested in low-risk portfolios, and that you and your family are fully covered in life and healthcare insurance.

The main principle is keeping your expenses lower than your income. Looks simple and easy, but in reality, it is very hard to follow. Wants and cravings have to be satiated, moms are prone to kids’ guilt trips, and unexpected expenses are always around the corner. The key to embracing the principle is rechanneling your focus to your family and your goals. Stop looking and comparing your house to your neighbors’. You will be surprised to know the huge mortgage they are struggling to pay off every month.